By Riley Kaminer

The vast majority of businesses in the United States are small and medium-sized. These companies create two-thirds of all new jobs. And Miami significantly over indexes on small businesses.

There’s a problem though, local entrepreneur and investor Zaid Rahman told Refresh Miami. “There are just too many tools in B2B finance. The reality is that most SMBs don’t have CFOs, so what ends up happening is that business owners just keep all this stuff in their head or in Excel.” Equally, Rahman noted, SMBs often lack the working capital necessary to keep their business ticking over.

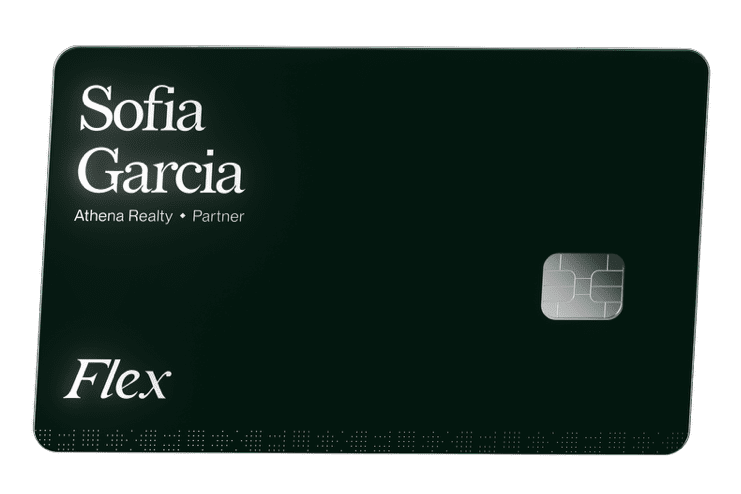

Solving these two problems is why Rahman founded Flex (formerly known as Flexbase) alongside co-founder Hadi Solh in 2020. Today, the company announced a fundraise that will significantly fuel this goal: $100 million in debt financing and $20 million in equity.

The Series A equity round was led by Florida Funders, one of the state’s most active VCs with a portfolio that includes 23 Miami-based startups including Betr, Lula, Healthsnap and Togal.AI. Participating in Flex’s round were Home Depot Ventures, MS&AD Ventures, Companyon Ventures and others.

Rahman explained that the equity fundraise will be used to hire the resources necessary to execute Flex’s ambitious product development roadmap, as well as the marketing and sales personnel needed to grow the business overall.

The debt financing portion was led by institutional impact investment manager CIM and will power Flex’s credit card business. As its flagship product, the credit card enables users to pay on net-60 terms.

On top of the credit card offering, Flex aspires to be a central platform that bundles all the various back-office finance functions for SMBs: everything from expense tracking to banking to treasury management and beyond.

“We’re super excited to see Flex’s growth,” said Florida Funders General Partner Saxon Baum. Flex’s platform has served upwards of 25,000 small businesses since launching. “We think that this could be one of the biggest companies coming out of Miami. Zaid is a once-in-a-lifetime founder: a Thiel Fellow, and someone who’s building things in the right way. We’re super excited to be behind him and the team and triple down on Flex.”

“As investors focused on providing capital to small businesses in underserved communities, we are excited by Flex’s potential to provide small businesses with access to responsible credit and the flexibility they need to manage their cash flow and growth,” Jeff Hilton, managing director of CIM, said in a statement. “We’re eager to continue to support Flex as they provide innovative cash flow management products and solutions.”

Rahman, who grew up in Dubai, moved to Miami from Silicon Valley in October 2020. In 2021, the serial entrepreneur raised $2.5 million in pre-seed funding for his new startup. Rahman is also a founding partner in the Miami-based early-stage venture fund 305 Ventures.

Construction companies were the initial focus of Flex, in large part because much of Rahman’s family is active in the space. Once the startup started serving clients though, Rahman realized just how prevalent the financial management issues were for SMBs in all verticals – and just how few financial institutions and fintechs fairly and effectively serve these customers.

“We are enabling business owners to achieve the American dream,” Rahman proclaimed. “We want to be the best product our business owners have ever used, and we want to help them build enduring businesses.”

READ MORE IN REFRESH MIAMI

- The sky’s the limit for construction companies using Flexbase’s new credit card

- Industry-backed Suffolk Technologies is unlocking VC dollars to usher in the next era of construction tech

- DigiBuild secures $4M seed round for blockchain-based construction management platform

- Novo secures $125M to provide small businesses with working capital

- New fund 305 Ventures doubles down on Miami as a hub for promising startups