By Riley Kaminer and Nancy Dahlberg

Brickell was swarming with more finance folks than usual earlier this week at the 2023 Florida Venture Capital Conference, organized by the Florida Venture Forum.

Over the course of two days, upwards of 700 investors, entrepreneurs, and innovation ecosystem supporters took over the J.W. Marriott to discuss all things Florida Tech.

Miami was a key focus throughout the event – not just because of the conference was located here this year, but because of the major role South Florida builders and funders play in our statewide tech ecosystem.

Organizers crowned City of Miami Mayor Francis Suarez as “Venture Leader of the Year” after he gave a stirring speech underscoring the “tsunami of opportunity” stemming from technological advancements.

“This is a transition from a highly industrial economy to a highly digital economy – and Miami has been at the forefront of this disruption,” said Suarez. The Mayor asserted that the venture capital ecosystem has grown 500% over the last two years, on top of becoming a major destination for tech job growth and foreign direct investment.

In an interview with Refresh Miami, the Miami-based president and CEO of the Florida Venture Forum, Kevin Burgoyne, echoed Suarez’s sentiments. According to Burgoyne, this has been a record year for the conference, which had its highest number of overall attendees, out-of-state attendees, and investor attendees. That’s due, at least in part, to the excitement around #MiamiTech.

“We’ve done a good job of marketing ourselves in a non-hype way,” said Burgoyne, despite much of the Miami hype that comes from policy leaders, investors, and entrepreneurs. “We’re catching up to the hype now.”

“In Florida and in Miami from 2021 to 2022, VC has been trending positive – while in the broader US, the VC market was down,” noted Burgoyne. Indeed, venture capital flowing into South Florida in 2022 hit another record high, when nationally venture activity fell by more than 30%.

Shared at the conference were top-line findings of a new research report by The Washington Economics Group. The total economic impact of VC and VC-backed private equity investment in Florida was $85.4 billion from 2012 to 2021, the report found.

Healthtech in focus

Two separate panel presentations focused on healthtech, reflecting the continued growth of this tech sub-sector.

Papa founder and CEO Andrew Parker shared his story of scaling the startup past its Series D, starting his journey right down the street in the Brickell City Center WeWork. “Our inflection point was when people started to love our platform, and it became clear that it was not going away,” Parker recalled. Papa’s service, available nationwide through health plans, combats loneliness and isolation among seniors. Papa employs over 600 now.

Meanwhile, Cody Simmons, the Miami-based CEO of DermaSensor, a startup focused on detecting the risks of skin cancer, revealed the trials and tribulations of building in the healthtech space – specifically, when it comes to FDA approval. “Don’t be too optimistic about how long things will take,” he told a packed room of attendees. Indeed, the regulatory journey is arduous, but Neocis’ founder Alon Mozes is seeing results now that 120,000 dental implants have been performed by Neocis’ robots.

But it’s not just startups that are innovating in the Healthtech space. Executives from Mayo Clinic, Baptist Health, Tampa General Hospital, and UM’s Miller School of Medicine took to the stage to outline how major health systems play an important role in our innovation ecosystem.

“We’re focused on how to improve patient outcomes and the patient experience,” shared Rachel Feinman, the VP of Innovation at Tampa General. She noted that it is critical for any innovation program to have buy-in from the executive team.

“We need innovation,” said Charles Bruce, chief innovation officer for the Mayo Clinic in Florida. He noted the famed health system’s two funds for medtech: one philanthropic fund for early-stage companies and a $500 million seed fund for technologies of strategic importance to the Mayo Clinic.

Startups vie for investor attention

Throughout the day, startups from South Florida and beyond networked in the hallway with investors and some, like Streann, exhibited their solutions.

Investors could also listen to 5-minute pitches from 32 presenting startups – 15 of them from the Miami metro area. The startups ranged from those in healthtech, spacetech, fintech and enterprise SaaS to those focused on disrupting the future of work or saving the planet.

For instance, Sanjay Chopra, the CEO of Cognistx, an applied AI startup born at Carnegie Mellon with a team in South Florida, pitched how his company is bringing AI and data analytics systems to drug discovery. Tim Sperry, CEO of Carbon Limit, explained how the Boca Raton startup is combatting CO2 pollution through its carbon capturing cement.

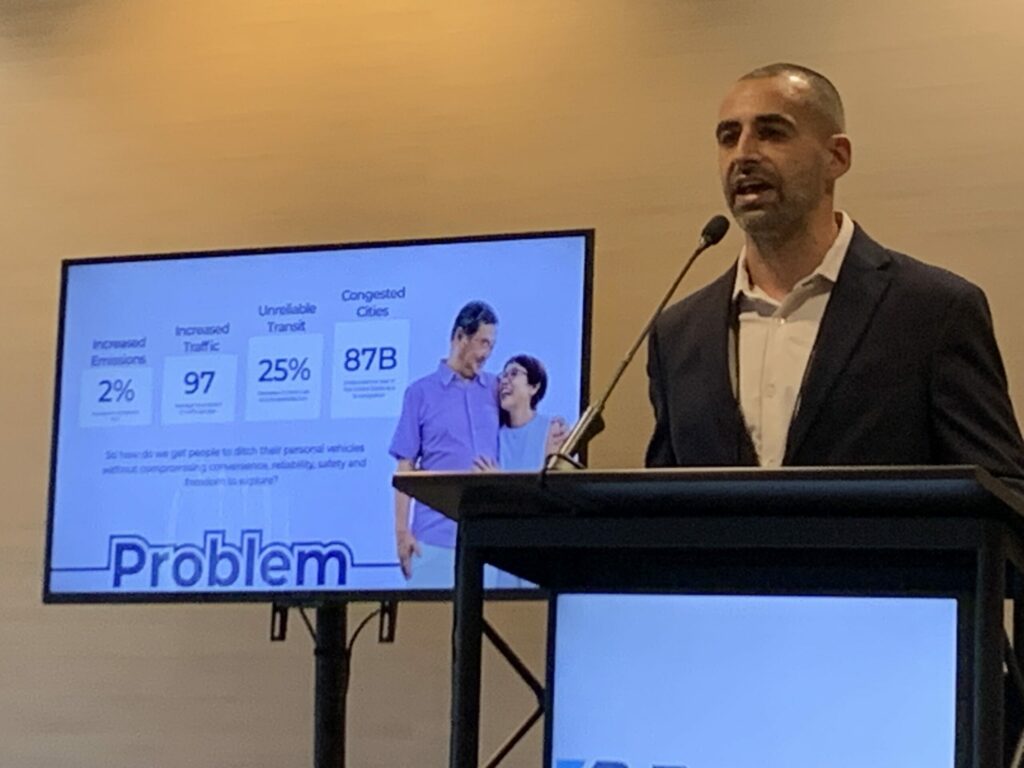

They were all hoping to attract investor interest. Digibee, the Weston-based startup focused on enterprise digital transformations, is aiming to raise $50 million on the heels of its $25 million Series A. Jason Spiegel of Miami-based Freebee {pictured above] pitched his free electric-vehicle mobility service, seeking $20 million to expand nationally. BlockSpaces, a Tampa Bay startup led by Rosa Shores [pictured below], is raising several million to grow their low-code/no-code platform that connects Web2 applications to Web3 payments and processes.

READ MORE ON REFRESH MIAMI:

- BOOM! Miami metro hauls in $5.5B in VC in 2022, a new record, Pitchbook reports

- Growing the tech talent pipeline is what Miami Tech Works is all about. Employers, here’s how to get involved

- Buy, rent, sell, manage: Miami’s proptech ecosystem may be as hot as our real estate market

- Tom Brady will keynote at eMerge Americas, plus more updates on the homegrown Miami tech conference

- Miami startup Moderne raises $15M to bring continuous software modernization to market

- How Venture for America fosters accessible, inclusive entrepreneurship in Miami

- What happened in Miami tech in 2022? We’ve got the recap for you!