By Nancy Dahlberg

Macro economic indicators may be signaling a possible downturn and venture pullback ahead, but the mood at the 2020 Florida Venture Capital Conference in Orlando this week was decidedly bullish. And why wouldn’t it be? The Sunshine State just came off a record-setting year for venture capital.

“2019 was an outstanding year for venture in Florida, with a healthy funding landscape showing strong momentum statewide,” said Kevin Burgoyne, President and CEO of the Florida Venture Forum, which produces the annual conference. Some of the attending investors said that deal flow from the state has been strong and they anticipate a busy year ahead.

The Forum, Florida’s largest statewide support organization for investors and entrepreneurs now in its 36th year, released its second annual Florida Venture Report at its conference, which took place this week at the JW Marriott Grande Lakes in Orlando.

Here are a few highlights of the report, produced in partnership with Pitchbook. You can see the full report here.

- As Refresh Miami already has reported, total deal value hit a record $2.9 billion, with Miami-Fort Lauderdale region accounting for the bulk of it. However, the report noted that other startup regions, such as Tampa Bay, are showing steady growth.

- US investors outside Florida participated in 53 deals and accounted for $1 billion of the deal value, a dip from 2018. The report also noted that European investor participation is on the upswing.

- Here’s an interesting data point: Median early-stage deal size (Series A) hit a record of $3.5 million – that is up from $2 million two years ago – showing the continuing maturing of the marketplace.

- Momentum: 15 Florida venture firms have been formed since the start of 2015, and they have closed on nearly $350 million in commitments. While small now, these funds will likely become follow-on vehicles and pursue the typical pattern of sizing up in order to fund larger opportunities, the report said.

- CVC activity pulled back significantly statewide after its runup in 2016-2018, peaking in 2018 with 27 transactions and $1.1 billion in deal value.

“Florida‘s venture ecosystem saw a decade-high level of deal value invested in 2019, with increasing interest from out-of-state and European investors – a positive signal of the state’s ability to attract VC financing” said James Gelfer, Lead VC Analyst at PitchBook. “As the scale of accessible investment opportunities in the Florida startup ecosystem grows given company maturation, managers of successfully deployed smaller funds will find more targets and consequently pitch larger vehicles to gain exposure to all available, worthwhile opportunities.”

The Forum said it will continue issuing statewide venture reports, as well as continuing to track the funding progress of companies that present at its conferences. Since its founding in 1984, over 1,200 companies have presented at various Forum events and conferences, and past Forum presenters have gone on to raise $6.3 billion in equity capital, said Travis Milks, Managing Partner of Stonehenge Growth Equity Partners and Chair of Florida Venture Forum’s board.

That’s something that Forum attendees were celebrating, too — a stronger ecosystem of companies based in Florida. And some of those past presenters who have raised large sums and grown quickly – including Reef Technology, Fattmerchant and Neocis, were in the spotlight at the conference. Sixteen other ventures from around the state hoped to be part of those statistics in the future. They presented their companies with six minute pitches and then were questioned by panels of investors. Those presenting companies included Vigilant Biosciences, Intercept Telemed, RSPECT Sports Tech and Nuvola from South Florida.

Suneera Madhani, founder and CEO of Orlando-based Fattmerchant and daughter of Pakistani immigrants, called herself a reluctant entrepreneur. But while working in the payments industry, she was appalled by the poor customer experience and knew there had to be a better way for payment processing through a subscription. With much encouragement but just $20,000 in the bank, she took the entrepreneurial leap in 2014 because it was the right time, right place and right space. “We did $5 million in payments our first year and we did $5 billion in payments last year,” she told the crowd

Suneera Madhani, founder and CEO of Orlando-based Fattmerchant and daughter of Pakistani immigrants, called herself a reluctant entrepreneur. But while working in the payments industry, she was appalled by the poor customer experience and knew there had to be a better way for payment processing through a subscription. With much encouragement but just $20,000 in the bank, she took the entrepreneurial leap in 2014 because it was the right time, right place and right space. “We did $5 million in payments our first year and we did $5 billion in payments last year,” she told the crowd

Fattmercant employs 110 now, but Madhani told the story about how in the very early days she used multiple variations of her first name answering calls to appear to be a bigger company than they were. To this day, the team still celebrates the wins as they gain customers. Fattmerchant, which presented at FVCC in 2017, has raised nearly $20 million, a journey starting out with investments from Florida’s Arsenol, FanFund and Venvelo. [Read more about her story on Refresh.]

REEF Technology (formerly ParkJockey, a FVCC presenter in 2015) has been in the news lately for its unveiling of its REEF Kitchens – and for reeling in the state’s largest venture investment. Last year, the company rebranded because the company had become the largest operator of parking lots and garages in North America with 5,000 locations. “We had a vision that is now being executed to take those parking facilities, and in addition to using them as a place to just put your car, to recognize they are great high density locations near where lots of people live and work. We imagined new use cases for that real estate,” said Alan Cohen, CMO of Reef.

One of those early use cases: Delivery-only kitchens for up to five restaurants to plug right into REEF’s infrastructure. “We are having a lot of discussions with regional companies, large national chains and mom and pops because everyone sees and opportunity,” Cohen said. Another early use case is for creating distribution facilities for trucks for last-mile deliveries, rather than the trucks clogging city streets, he told the audience.

“We look at the parking lot as an open playing field – today we think its distribution centers, charging stations, kitchens, but in the future who knows?” For example, he said REEF is in discussions with an Israeli emergency services organization that wants to expand into the U.S. “There are a lot of possibilities we are excited about.” [Read more about REEF on Refresh.]

Neocis, the Miami robotics company that raised $30 million in venture capital, manufactures robotic surgery systems focused on the dental implant industry, providing a minimally invasive procedure that can lead to faster healing and less pain for the patient, CEO and co-founder Alon Mozes told the crowd. “Dental implants is a huge market and most importantly the clinical value this kind of robotic surgery brings is very advantageous to this kind of procedure.”

Neocis, the Miami robotics company that raised $30 million in venture capital, manufactures robotic surgery systems focused on the dental implant industry, providing a minimally invasive procedure that can lead to faster healing and less pain for the patient, CEO and co-founder Alon Mozes told the crowd. “Dental implants is a huge market and most importantly the clinical value this kind of robotic surgery brings is very advantageous to this kind of procedure.”

Mozes credits patients and a lot of scrappy efforts in the early days for its success. Networking connections were critical. An early advisor connected him with the Beacon Council, which gave the startup advice on tax breaks for R&D and manufacturing. Beacon Council connected Mozes with Pipeline for office space. Through networking with the Florida Venture Forum – Mozes presented at the conferences twice – he also met his first attorney John Igoe. An early believer and investor was Fred Moll, known as the father of robotic surgery, and that brought other interest. Since then Neocis has brought in institutional investors. “Put yourself out there and network as much as possible,” he said.

Neocis is now in its commercialization phase. More than 40 Neocis robots are now placed around the country. “We did more than 1,000 implants in 2019 alone.” What could be next: There is potential in other indications, perhaps making Neocis a platform play, Mozes said. “Your robot will never be in a bad mood, they will never wake up and be groggy, they will be very consistent and deliver the best care every time.” [Read more about Neocis on Refresh]

Hoping to attract the attention of some of the 120 or so venture investors in the room, 16 startups from around the state presented to the audience. These South Florida companies made presentations:

- Intercept TeleMed, of Weston, is a Tele-ICU platform and services that aims to revolutionize critical care in hospital ICUs. The company uses telemedicine, smart technology and Critical Care Professionals to provide care-as-a-service in hospital ICUs “proactively rather than in a reactive fashion. which is what most of healthcare looks like today,” said Dr. Diego Reino, CEO. “Our most notable contracts are with Dartmouth Hitchcock Medical Center in New Hampshire.”

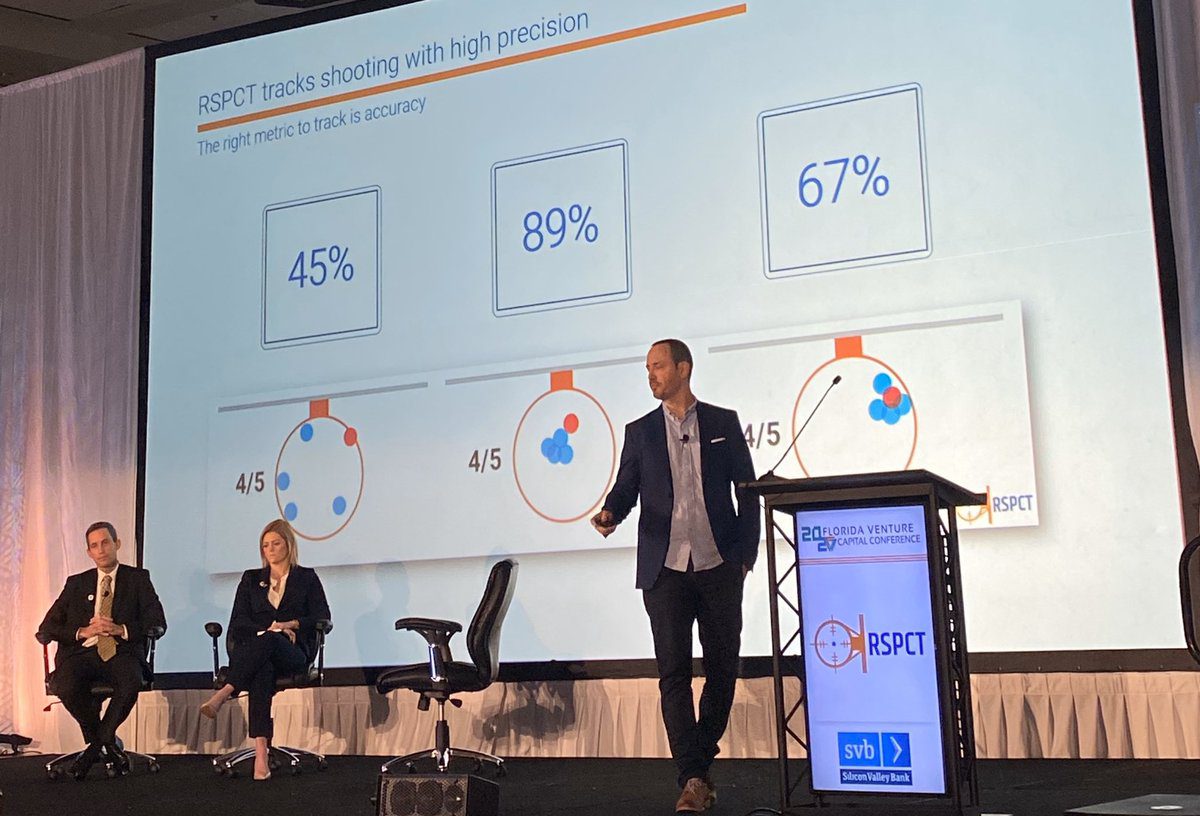

- RSPCT Sports Tech, based in Davie, developed basketball shot tracking technology in Israel and from it is creating hardware and software solutions to improve shooting, player development and team decision making. The company has had a team in South Florida for about 3 ½ years. CEO Leo Moravtchik said RSPCT already serves NBA players and will be expanding to college teams, high school teams and even amateurs playing in the back yard.

- Vigilant Biosciences, of Fort Lauderdale, is a leading innovator and developer of low-cost solutions that aid in the early detection and intervention of oral cancer. CEO Robert Hamilton said the company is on track for an FDA approval by the end of the year and it has signed a very large deal with a major dental distributor to get the product into the marketplace.

- Nuvola, of Miami, led by CEO and founder Juan Abello, was also scheduled to present. Nuvola a comprehensive hotel software company that integrates property standard operating procedures into its proprietary system, leading to more efficient back-of-house operations, asset management and guest engagement. The company, run by a team of former hoteliers and tech experts, equips hotels with an intuitive and scalable cloud-based solution that develops a system of staff accountability, its website says.

Conference attendees, like myself, who weren’t looking forward to the drive back to South Florida, might take comfort in what luncheon speaker Patrick Goddard, CEO of Brightline, had to say. The speedy trip to Orlando via Brightline should be reality by the end of 2022. For those heading west, a route from Orlando to Tampa, perhaps with a stop at Disney World, is still in the plans but with contractual deals still to be sealed, it is too early to make any predictions on that one.

Conference attendees, like myself, who weren’t looking forward to the drive back to South Florida, might take comfort in what luncheon speaker Patrick Goddard, CEO of Brightline, had to say. The speedy trip to Orlando via Brightline should be reality by the end of 2022. For those heading west, a route from Orlando to Tampa, perhaps with a stop at Disney World, is still in the plans but with contractual deals still to be sealed, it is too early to make any predictions on that one.

Follow @ndahlberg on Twitter and email her at [email protected]

- Human ingenuity, inspiration, a call to action: Miami Tech Talent Coalition takes the stage at eMerge Americas - April 24, 2024

- Miami Tech Month, where developers get their own conference, VCs take the stage, and anything is POSSIBLE - April 23, 2024

- Full circle moment for Johanna Mikkola, the new CEO for Tech Equity Miami - April 22, 2024