By Nancy Dahlberg

Over the past few years, Kiddie Kredit has helped thousands of children learn about the importance of building credit while they’re having fun earning rewards. Today, the Miami-based startup has announced it has raised $1.4 million in funding and has plans to expand the depth and reach of the financial literacy app.

Investors include Nueterra Capital, Plain Sight Capital, Fuerza Ventures, Verve Capital, and angel investors and former pro athletes Dwyane Wade and Baron Davis.

“The app’s innovative approach to credit education, coupled with the leadership and experience of founder Evan Leaphart, has the potential to empower future generations to make informed decisions and set them up for success,” said Marcelo Franco of Verve Capital.

Wade, the retired Miami Heat star player, said he’s also excited to watch Kiddie Kredit grow. “I was drawn to what Evan and team are working on with Kiddie Kredit. It’s important to give kids a head start and especially on the topic of credit.”

Leaphart learned about financial literacy the hard way. His journey through college, apartment hunting, unemployment, and business ups and downs exposed him to how much a credit score can impact life’s options. After rebuilding his own credit, Leaphart became a mentor to kids in South Florida, teaching them core concepts of finance and credit. He combined his passions for entrepreneurship and financial literacy education to found Kiddie Kredit with a mobile app that teaches children the foundations of credit in a fun, gamified way.

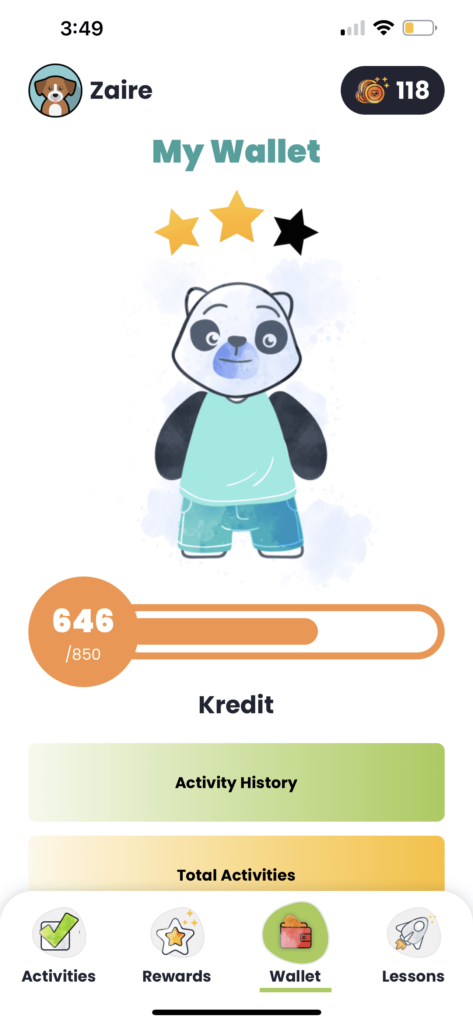

Used by more than 12,000 families, the Kiddie Kredit app is currently aimed at 4- to 12-year-olds. Through the app, parents assign activities and chores such as finishing homework or cleaning their rooms. As a child completes the tasks, the child’s Kredit Score will move up – or down if they don’t – moving between 300 and 850, similar to a real credit score. Kids can earn “Bamboo Bucks” that they can redeem for rewards. Families can download the app for free on iOS and Android devices.

But Kiddie Kredit has never built a business model that monetizes through the parents. And there’s the rub: How would it make money? That’s where Kiddie Kredit’s partnership with Equifax came in in 2021, and that partnership is still going strong, most recently adding advertising of the Equifax Family Plan to the parent side of the Kiddie Kredit app.

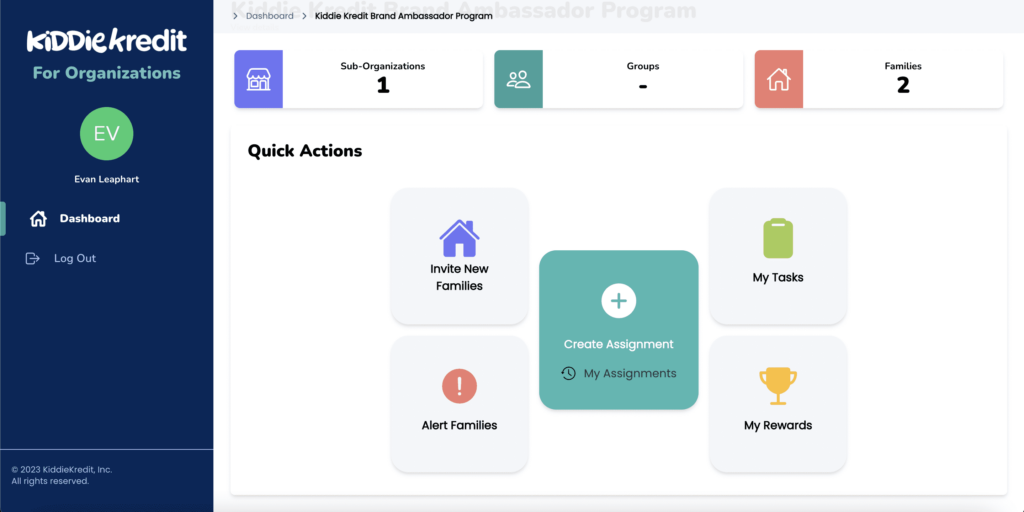

Last year, Kiddie Kredit finished building a web platform that allows organizations such as Equifax and others to interact directly with the app so they can add activities and rewards and send push notification to parents. For example, YMCA could offer a field trip as an activity.

“Most importantly, organizations can unlock for families this entire financial literacy journey of over 250 hours of content that meets multiple National Financial Literacy Standards,” says Leaphart, who is CEO of Kiddie Kredit.

In 2022, Kiddie Kredit participated in Amazon’s Black Founders Build with Alexa cohort and Google for Startups’ Black Founders Fund. In 2021, Leaphart also participated in an EndeavorLAB cohort, and that was a also a year in which Leaphart won 11 pitch competitions, bringing in about $100,000 in grants. Kiddie Kredit began generating revenues in 2021 and they grew 150% between 2021 and 2022, all organically with no marketing budget, Leaphart said. “This year, we’re tracking significantly higher.”

Now with the funding, Kiddie Kredit plans to increase partnerships with enterprises and expand the reach of the app. Essentially, as a product, Kiddie Kredit is growing up.

Kiddie Kredit has always been for the 12 and under audience, but what about teens? “We were fortunate to have participated in the Falls Fintech accelerator over a year ago by way of Discover and through that our exploration began into how we can expand our journey into the teen space,” Leaphart said.

For that consumer, the CEO would only say that Kiddie Kredit is planning to expand that journey with a follow-on product that could incorporate a true credit product for the teen-plus market. It’s all part of what’s next for Kiddie Kredit. Stay tuned for details in coming months.

“We want to own the space of Generation Alpha. What we want to be is the domain experts within that space,” says Leaphart. The oldest among Generation Alpha is turning 13 this year. “We’re with them on that journey.”

READ MORE ON REFRESH MIAMI:

- Future of work startup GiGL expands to Miami, launches video job platform with big hospitality employers

- Venture capital took a nosedive in Q1. Here’s how the Miami metro area fared and the top deals

- Miami startup fighting crypto crime raises $4.3M pre-seed

- Digital collectible marketplace LALA launches with $3M from Seven Seven Six

- 10 years after launch, Miami-based Ironhack grows global bootcamp network

- Proptech startup Giraffe360 officially makes Miami its US headquartersrtups

Got news? Email Nancy Dahlberg at [email protected] and follow her on Twitter @ndahlberg

SUPPORT LOCAL NEWS: Refresh Miami is proud to keep our news articles free and accessible to all. If you enjoy our content, please consider supporting us by becoming a paid subscriber or making a donation.

- 8+ things to know in #MiamiTech: Big role for Matt Haggman plus news about On.Energy, VC, Betr, Chewy, TokenizeThis, FreshCodes, Magic Leap & more. - April 26, 2024

- Human ingenuity, inspiration, a call to action: Miami Tech Talent Coalition takes the stage at eMerge Americas - April 24, 2024

- Miami Tech Month, where developers get their own conference, VCs take the stage, and anything is POSSIBLE - April 23, 2024