By Riley Kaminer

The U.S. is the biggest economy in the world, so who wouldn’t want to sell into our market? Finding success stateside is a great dream – but the reality is often much more complicated.

That’s exactly what Peter D. Spradling realized as he started sourcing products abroad to sell within the U.S. On top of the administrative burdens, access to capital was significantly more difficult than he thought it should be. So in 2020, he partnered up with Jacob Shoihet to build Marco, a platform that aims to unlock trade financing for Latin American SMEs that export their goods to the U.S.

Today, the company announced that it has raised $12 million to accelerate and expand these efforts in a Series A funding round led by IDC Ventures, a VC with a major Miami footprint. Local investors Miami Angels, SquareOne Capital, Neer Venture Partners, and Florida Funders also participated in the round alongside the IDB Lab (the innovation and venture laboratory of the Inter-American Development Bank Group), Barn Invest, Arcadia Funds, and others.

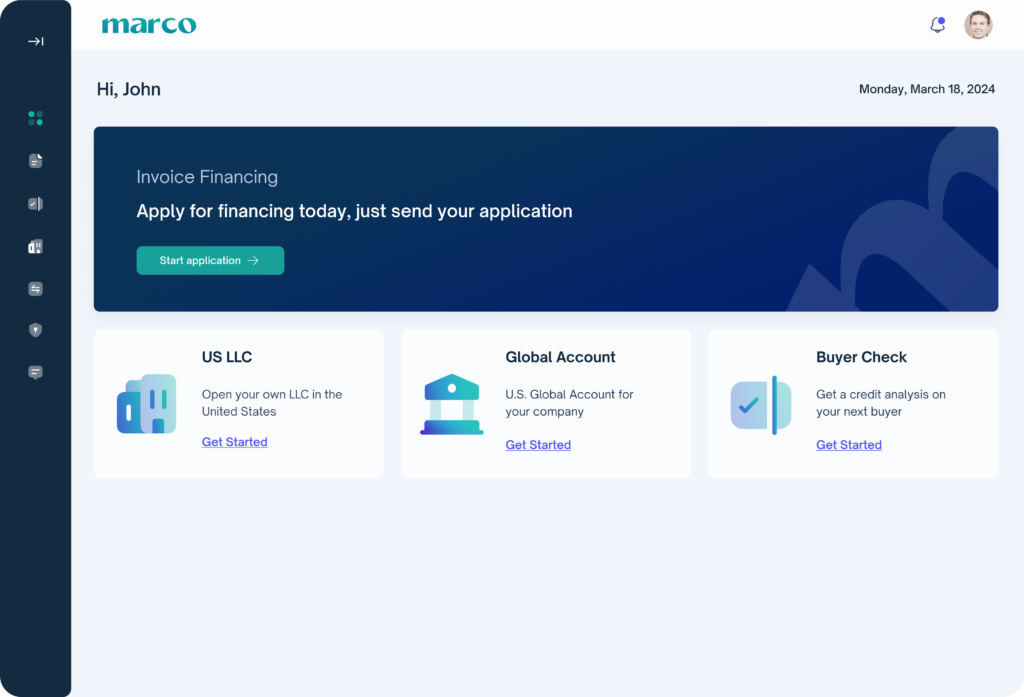

In an interview with Refresh Miami, CEO Shoihet signaled that Marco will leverage these funds to build additional products to further support its current user base. This includes their US global accounts product, which will help customers get set up with a U.S. bank.

“We are holistically focusing on our CFO suite of needs of our customers,” he said of the expansion beyond providing credit to also offering compliance, bookkeeping, banking solutions, and more.

According to Shoihet, the Marco team noticed that traditional tech products like Xero or QuickBooks have not penetrated the LatAm market to the same extent as in the U.S. However, the oversight that these kinds of platforms give users can play a critical role in their growth, and Marco is planning to help fill this technology gap. “Every business – no matter what it is – starts with its finances,” he asserted.

That said, Shoihet said that in the future we can expect to see Marco expand even further, perhaps through marketplace and logistics solutions – and even a soon-to-be-announced strategic partnership with a credit card network. “For now, we’re focusing on financial products,” he acknowledged.

Since launching in 2020, Marco has surpassed $540 million in cumulative volume funded, comprised of more than 63,000 receivables, and enabled by 1,700+ primarily investment-grade debtors. Last year, Refresh MIami reported that Marco closed a $200M credit facility alongside an $8.2 million equity fundraise.

“The overwhelming demand for Marco’s solutions highlights the critical need to modernize and automate operations for SME exporters in LatAm, who have been long constrained by a lack of financing as well as antiquated ‘pen and clipboard’ workflows,” Bobby Aitkenhead, IDC Ventures’ managing director, said in a statement. Aitkenhead and team have been vocal about the opportunity Miami has to build bridges between LatAm and the U.S. through Miami.

“By centralizing operations and democratizing access to capital, Marco is not just facilitating business growth; it’s profoundly impacting lives by catapulting an entire region and industry into the digital age,” Aitkenhead continued. “Backed by an exceptional team and a clear vision for a better future, Marco shines as a beacon of welcome disruption, and we’re excited to support its journey.”

Around 10 of Marco’s 50 full-time employees are based in Miami. Hiring is not a major focus at the moment, but the company does plan to hire a few people to enable growth across their product, engineering, and go-to-market strategies. The lion’s share of these new team members will be in Latin America, but Shoihet said we can expect a few to be Miami based.

“Peter and I moved to Miami in June 2022, and we have no plans in ever leaving,” said Shoihet, adding that Marco’s location here enables it to easily access the LatAm market. “Miami will forever be our headquarters and our home.”

READ MORE IN REFRESH MIAMI:

- Marco secures $200M to grow LatAm-focused SME financing platform

- Q&A: Jaclyn Baumgarten on her transition from startup founder to investor

- Scaleup SellersFi closes $300M credit facility, plus equity raise from Citi and Mitsubishi

- QUASH lands $3.7M seed round to expand Latin American credit platform

- Tukki takes the headaches out of U.S. visa applications