New reports by eMerge Americas and Panoramic Ventures shed light on VC momentum

By Nancy Dahlberg

We’re in a crypto winter, but you wouldn’t know it in Miami. The sector of startups focused on crypto currencies, blockchain or NFTs is hot, hot, hot — and that’s just one of the findings in eMerge Americas’ new report highlighting the first half of the year in venture capital. The 20-page report was authored by me and included in eMerge Magazine released this month.

Riding the Miami momentum, the Miami-Fort Lauderdale area had an explosive first half of 2022, showing no signs of a venture capital slowdown that was seen nationally and globally. The report found:

- $3.1 billion was invested in South Florida startups and later-stage companies across 209 deals in 1H-2022. Compare that to $5.3 billion across 285 deals for all of 2021. [Update: Through Q3, the total is at least $4.6 billion, putting the metro area well on track for a possible record-setting year.]

- In the first half, startups based in the Greater Miami metro area snagged 78% of the state’s venture capital take in dollars and over 64% of the deals.

- Financial technology took over as the most-active sector in 2021 and stayed atop in the first half of 2022, securing 37% of the venture capital dollars flowing to South Florida companies.

- Healthtech companies snagged 40 deals, well ahead of the 2021 pace. Yet, with no mega-rounds in the pack, the dollar value of deals fell back in the first half of 2022, with $297.5 million flowing into healthcare-related companies.

- Miami’s bid as the #CryptoCapital is gaining steam, as 21 crypto and blockchain deals totaling $732 million have been recorded in 1H-2022, following a strong Q4 in 2021. This represents 23.4% of the VC dollar volume flowing into all companies.

While the biggest raise of the first half was Yuga Labs’ $450 million round, our report also spotlighted startups raising seed rounds, shedding light on the region’s future. Seed rounds represented 38% of the deals in the first half, the largest category by far.

The eMerge Insights report also highlights key ecosystem news fueling the momentum, such as Andreessen Horowitz opening an office here and the launch of Tech Equity Miami, as well as events coming back IRL in a big way as the Miami migration continued to bring new startups and investors to the region. The report also includes statewide data and top deals.

Find much more in our 20-page report in the second issue of eMerge Magazine. Download it here. [You can also download our past reports from this link.]

About the Southeast

In a second report, Panoramic Ventures looks at VC trends in the Southeastern US in its new report, The State of Startups in the Southeast 2022. This sixth annual report delivers a comprehensive overview of the venture capital and startup ecosystems in the region, taking an in-depth look at activity from Jan. 1, 2017, through June 30, 2022. Its primary finding: Deal activity in the Southeast remains robust, despite a venture capital slowdown in the first half of 2022 in traditional innovation hubs like the Bay Area, New York and Boston. In the Southeast over the past five years, VC dollars totaled $65.9 billion and startup valuations doubled during that time period.

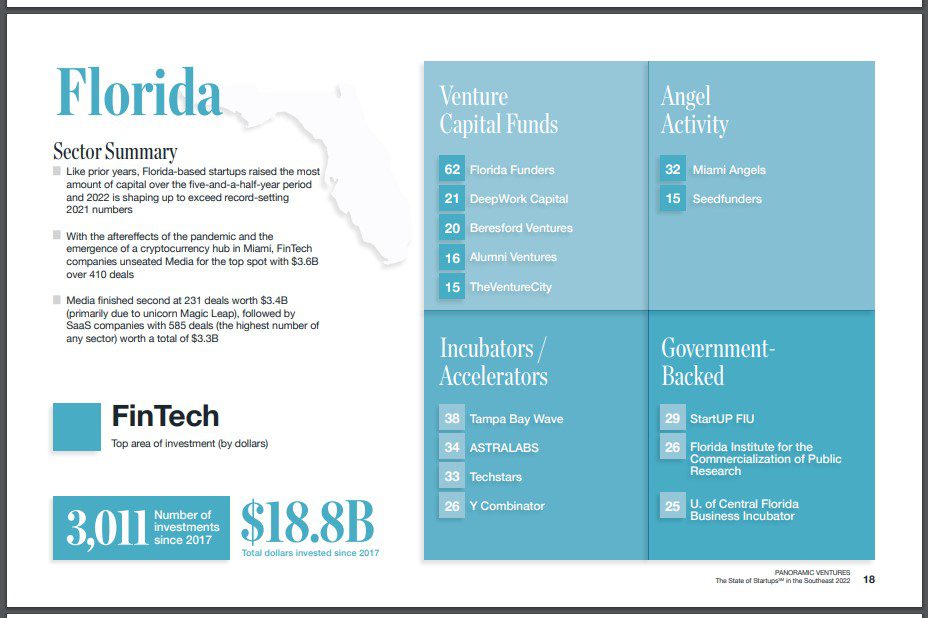

The report found that in the Southeast, Florida-based startups raised the most capital over the five-and-a-half-year period and the state’s 2022 is shaping up to exceed record-setting 2021 numbers. Sunshine State companies overall have received $18.8 billion in investments since 2017, spread over 3,011 deals, the report shows. The state has had 13 significant exits since 2017 and currently has 13 unicorns.

South Florida dominates in Florida, particularly in what Panoramic’s report calls “the emergence of a cryptocurrency hub in Miami.” That’s partially why fintech companies dethroned media companies for the No. 1 startup industry in the Sunshine State, with $3.6 billion invested over 410 deals, the report found. [Fintech also emerged as the No. 1 sector for VC activity in South Florida in 2021 and so far in 2022.] Media finished No. 2 in the state, with 231 deals worth $3.4 billion, followed by SaaS, with 585 deals worth a total of $3.3 billion.

Florida is home to 13 of the Southeast’s 32 unicorns, and 9 hail from South Florida: Yuga Labs, MoonPay, Kaseya, Pipe, Magic Leap, Material Bank, Papa, ModMed and Reef Technology.

The report also found that Florida Funders was the top investor in the Southeast (with 68 deals) and in Florida (with 62 deals). Investments include Betr, Lula, HealthSnap, Secberus and CryptoLeague, all from the Miami metro area.

Click here to read Panoramic’s comprehensive The State of Startups in the Southeast 2022 report.

READ MORE ON REFRESH MIAMI:

- Flow of Miami metro VC is strong in Q3 – and you can thank Adam Neumann for that

- Miami’s ecosystem regains its runner-up global ranking in Startup Genome report. Here are the top findings.

- Under Miami Angels’ new leadership, expect more membership growth and another record year for investments

- What does the future of the #MiamiTech movement look like? The Knight Foundation’s Raul Moas weighs in

Follow Nancy Dahlberg on Twitter @ndahlberg and email her at [email protected]

- Tech and politics do mix at 2024 Miami Tech Summit, with eye on the future - April 18, 2024

- #MiamiTech Everything: Seen and heard in April - April 17, 2024

- 8+ things to know in #MiamiTech: Dapta and Siprocal raise funding, plus news from Jeff Bezos, MoonPay, Sustainable Skylines, Freebee & more - April 11, 2024