Powered by Miami’s momentous and pivotal year in tech, South Florida venture capital broke all kinds of records in 2021: Highest total in dollars ever, highest number of deals, most yearly growth for both categories.

Both reports out this week – CB Insights’ State of Venture and Pitchbook-NVCA Venture Monitor – show similar trends: Bigger rounds, more mega-rounds, new unicorns.

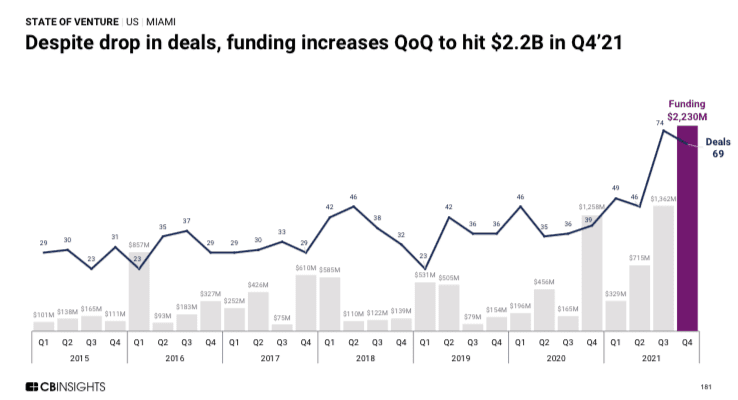

CB Insights’ global 2021 State of Venture report shows a $2.2 billion Q4 surge across 69 deals, catapulting the yearly intake for the Miami-Fort Lauderdale metro to a record-smashing $4.63 billion flowing into South Florida companies, up from $1.92 billion in 2021. According to CB Insights, the tri-county metro now ranks 11th among metro areas for dollars invested. As for deals, CB Insights said there was 238 deals in all of 2021, up 65% from 156 deals in 2020, its data shows. These included mega-rounds by Pipe, PayCargo, and four more that closed in Q4 (see below), among others.

The National Venture Capital Association and Pitchbook released their Q4 report, the Venture Monitor, and although the reporting methodology differs from CB Insights (Pitchbook includes angel deals and not private equity so it typically has a higher deal total and a lower dollar total), the trends were similar. For the year, Pitchbook found that $3.99 billion flowed into South Florida startups, but Pitchbook didn’t include the MoonPay. If that was included, it would be $4.5 billion. Pitchbook’s deal count for 2021 (again, higher because angel deals are included) was 263, up 45% from its count for 2020.

Here are the top 10 South Florida deals of Q4, according to Pitchbook*:

- MoonPay: fintech/crypto; Series A, Miami, $555 million

- Magic Leap: AR; Later Stage, Plantation, $500 million

- Healthcare.com: insurtech, Series C, Miami, $180 million

- Papa: healthtech, Series D, Miami, $150 million

- OpenStore: ecommerce, Series B, Miami, $75 million

- Recurrent Ventures: media, Early Stage, Miami, $75 million

- QuickNode: blockchain, Series A, $35 million

- Locality Bank IO: fintech, angel round, Fort Lauderdale, $35 million

- Faraway: game developer, Series A (& seed), Miami, $29 million

- Corellium: app security, Series A, Boynton Beach: $25 million

*MoonPay was not included in Pitchbook’s report but I added it. CB Insights includes MoonPay

The trends behind the numbers

In 2021, fintech was the dominant venture sector in South Florida for the first time, a trend we saw in the first half of the year that has continued. A surprise to no one: crypto/blockchain also came on strong in 2021. Deal sizes on average were bigger, too. Another pivotal trend I saw in 2021 for the first time: Some of the biggest names in venture were backing deals, and not just one of two outliers as in past years, were backing our startups, including SoftBank, Founders Fund, Tiger Global, Andreessen Horowitz, General Catalyst and Valar Ventures. Read more about the Miami metro region’s momentous year in Refresh MIami’s year in review here.

2021 was a big year for South Florida exits. After a few slow years, Pitchbook reports that there were a record 22 exits in 2021 totaling $3.56 billion; Terran Orbital was the leading exit in the 4th quarter. The active year was bookended by the exits of two #MiamiTech OGs: Nearpod and EveryMundo.

Florida also saw record-high deal flow last year. Investors poured $5.42 billion into 485 deals across the state.

Stay tuned for more me about the 2021 year, including my annual report for eMerge Americas, where I will produce a top deals list for 2021 (still verifying some information). My research is comprehensive, drawing from all three venture capital trackers and my own reporting, and my totals are typically higher. That is true so far this year as well. My early reporting puts the total about $5B. I will also be diving into the trends behind the deals, exploring South Florida’s exit year, and looking ahead. 2022 is already off to a strong start, with Miami-based digital bank Novo securing a $90 million Series B and NFT venture studio Metaversal raising a $50 million Series A.

US venture in 2021: up, up, up

The Miami trends mirrored national and global trends. Venture capital dealmaking, exit and fundraising values all broke records in 2021 by stunning amounts, according to the PitchBook-NVCA Venture Monitor. The top-line figures for the U.S. VC industry in 2021 show a staggering $329.9 billion was invested across an estimated 17,054 deals, a record for deal count and roughly double 2020’s previous deal value high. Investors raised an unprecedented $128.3 billion, passing the $100 billion mark for the first time, Pitchbook said. In addition, $774.1.4 billion in annual exit value was created by VC-backed companies going public or being acquired.

“By all metrics, 2021 was a banner year for the U.S. VC ecosystem,” said John Gabbert, founder and CEO of PitchBook. “A fair portion of the new investment records can be attributed to the record levels of capital washing through the system. VC dry powder at an all-time high and a rapidly growing number of crossover investors are participating in, or even leading, VC deals. With VC returns outpacing every other private capital asset class, we expect LPs to continue to allocate capital toward venture at unprecedented rates in the coming year.”

Latin American companies draw $20.2B in 2021, quadrupling 2020

Globally funding was up 111 percent to 621 billion, in the US funding rose 106% to $311 billon, according to the CB Insights report. But the real story was in Latin America, which saw $20.2 billion in funding across 952 deals. That’s an increase of nearly 4X in dollars from a then-record $5.4B in 2020 — or put another way, more than the total of the six previous years combined. Deals were up 73% from the 551 deals in 2020.

READ MORE IN REFRESH MIAMI:

- BOOM: #MiamiTech 2021, the recap

- Power ascent in progress, systems mostly stable: Miami to exit the atmosphere in 2022 (by Auston Bunsen)

- Novo secures $90M Series B to reimagine small business banking

- NFT venture studio Metaversal raises $50M Series A

Follow @ndahlberg on Twitter and email her at [email protected]

- Tech and politics do mix at 2024 Miami Tech Summit, with eye on the future - April 18, 2024

- #MiamiTech Everything: Seen and heard in April - April 17, 2024

- 8+ things to know in #MiamiTech: Dapta and Siprocal raise funding, plus news from Jeff Bezos, MoonPay, Sustainable Skylines, Freebee & more - April 11, 2024