By Riley Kaminer

Let’s say you just sold your house, but you have no immediate plans to buy a house – perhaps you want to wait out the market or rent for a while. What do you do with the cash you have hopefully (and statistically) made from that sale?

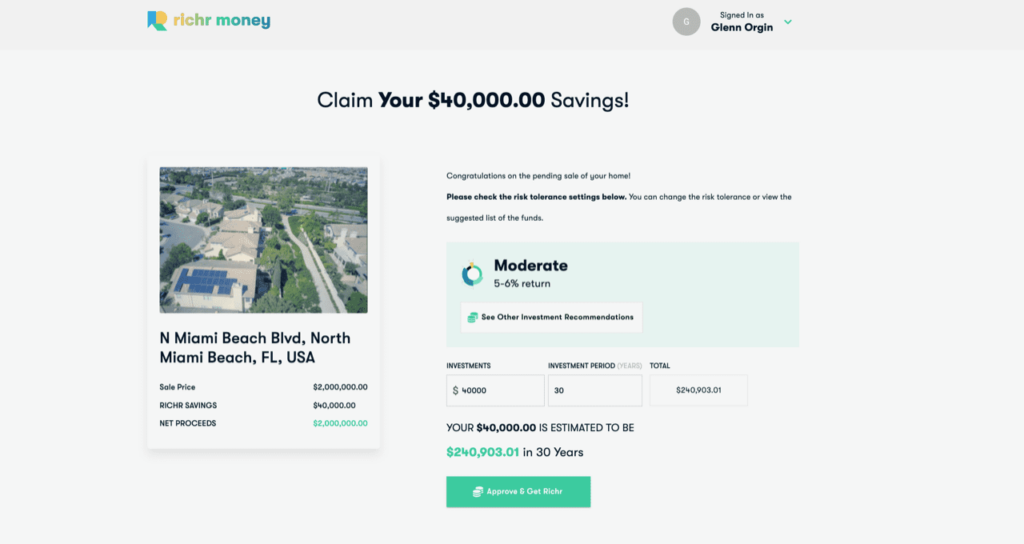

In Glenn Orgin’s experience, buyers too often end up simply sitting on that cash. Orgin is the founder and CEO of Richr, a platform that helps homeowners sell their property without a real estate agent. While most seller’s agents take a 3% cut, Richr just takes 1% of the net home sale, putting the remaining 2% back in its customer’s pocket.

To develop this platform, Richr brought together real estate brokerage and title settlement services – saving clients a bundle in the process. The company provides a full suite of real estate agent services, including marketing, contract review, negotiations, and closing services.

Orgin’s lightbulb moment came when he started looking around to figure out if there were any wealth management solutions tailored to clients that just experienced a liquidity event after a real estate sale. That’s when Orgin decided to build a product himself through Richr.

This week, Orgin and team launched Richr Money, a service that takes a Richr client’s proceeds from their home sale directly out of escrow and into a variety of investment products. “We believe wealth management is the next frontier in fintech and proptech,” Orgin told Refresh Miami.

Richr Money enables sellers to make a return on their cash while it’s on the sidelines. Orgin explained that, through their broker-dealer and in conjunction with a CFA, Richr Money has developed different portfolio options for clients based on their risk tolerance. The company charges a fee of 0.5 percent to manage these assets.

While Richr Money is currently only available to clients of Richr’s home selling and titling services, Orgin shared that they already have around eight commitments from users interested in the platform. Richr’s typical client is around 32 to 52 years old and includes both people looking for a digital ‘for sale by owner’ solution as well as people looking to save money in the home selling process.

Looking forward, Orgin expressed excitement in having real estate brokers leverage this service to build relationships with clients beyond their very infrequent house purchases.

“We’ve built Richr money in a capacity so that it could make any real estate broker and title company a wealth marketer,” he said. Orgin underscored the difference between a wealth advisor and a wealth marketer – the latter of which can leverage Richr’s plug-and-play solution to immediately offer this new product to their current clients.

Orgin founded Richr two years ago, leveraging his background working in real estate for a family office. While he said that the housing market is likely to experience a correction this year, he expects Florida to weather the storm better than most states – particularly because many companies continue to flock here.

“Working in tech in Miami is very exciting,” asserted Orgin. “You can feel the buzz wherever you go.”

READ MORE IN REFRESH MIAMI:

- Proptech startup Bungalow makes its HQ home in Miami’s Wynwood

- Get ready for Getaway: Real estate investing you can actually enjoy

- BCP Global launches one-stop-shop for Latin Americans’ USD needs

- PropTech startup DoorLoop raises $20M Series A round

- What happened in Miami tech in 2022? We’ve got the recap for you!

- Brought together by tech, kept together by culture: Miami’s protagonistic role in LatAm’s startup story - April 15, 2024

- New World Angels launches Innovation Fund to write pre-seed checks - April 12, 2024

- Sortium scores $4M to pioneer the future of game production (hint: it’s web3 and AI) - April 11, 2024