By Riley Kaminer

We need more housing – and fast.

About 750 people move to Florida every day. Three to a household translates to 250 new units of housing are needed each day just to keep up with demand.

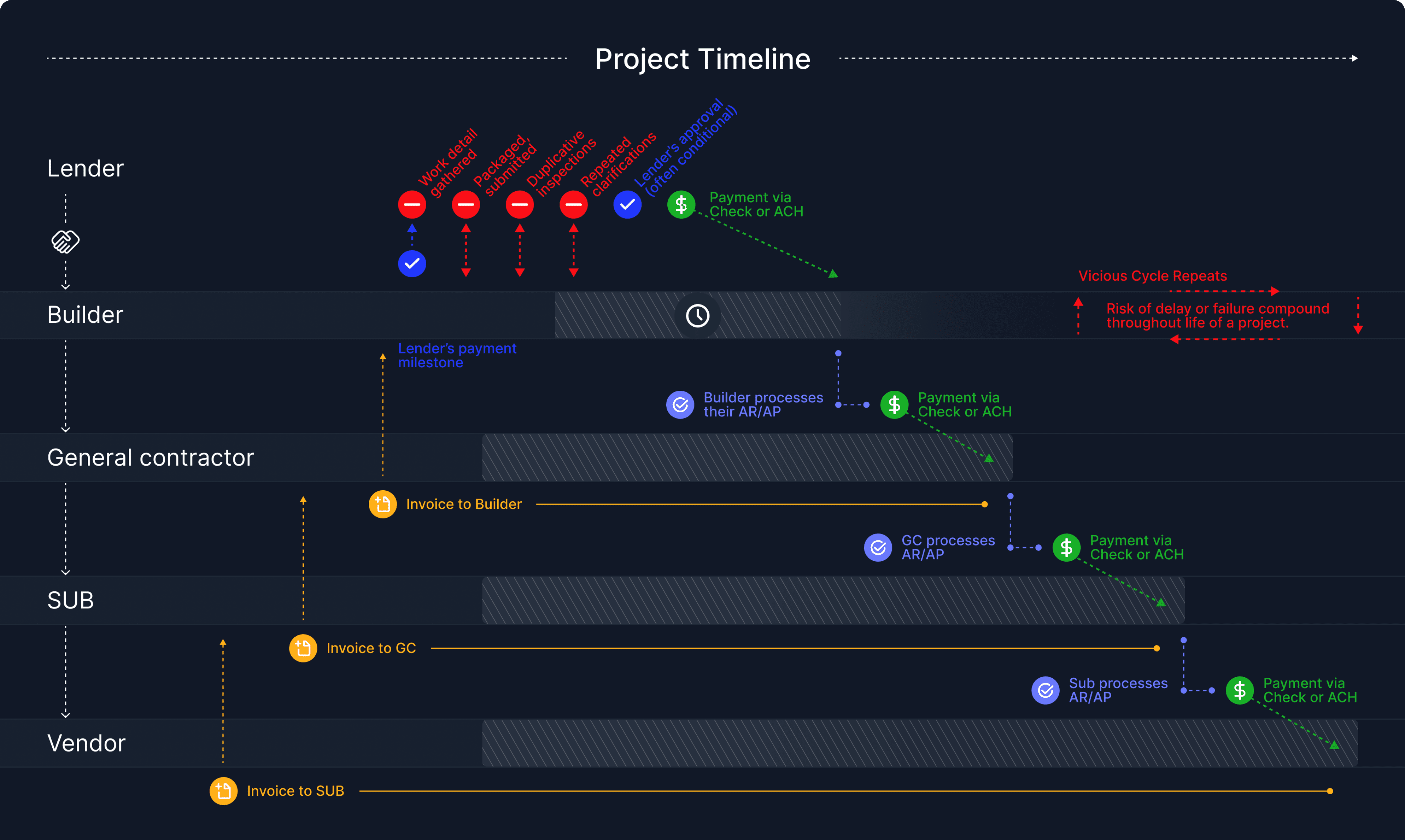

The problem? Construction projects can take 20% longer to complete than expected. 80% come in over budget. Construction companies’ access to capital is severely limited. And pandemic-induced supply chain struggles have made a bad situation worse.

It is in this context that DeFi startup Rigor has decided to innovate. The company has built a platform for community lending and instant payments for new home construction. The advantage of being blockchain-based? It simplifies the loan origination and administrative processes, offering increased transparency along the way.

Rigor has just announced a $3.5 million institutional seed raise from some of the biggest names in the game: Agya Ventures, Bain Capital Ventures, Digital Currency Group, Flow Ventures, Koji Capital, and Third Prime.

The startup reports that it will use these funds to make their software open source, introduce ownership incentives, grow their team, and scale the protocol globally.

“We are immensely pleased by the confidence these prestigious investors have shown in the promise of our DeFi protocol to free homebuilders from cumbersome and restrictive financing practices that needlessly hold back the supply of new and desperately needed housing,” Isaac Lidsky, Rigor’s co-founder and CEO, said in a statement. Lidsky co-founded Rigor alongside Miami Beach-based entrepreneur and business development executive Erich Wasserman.

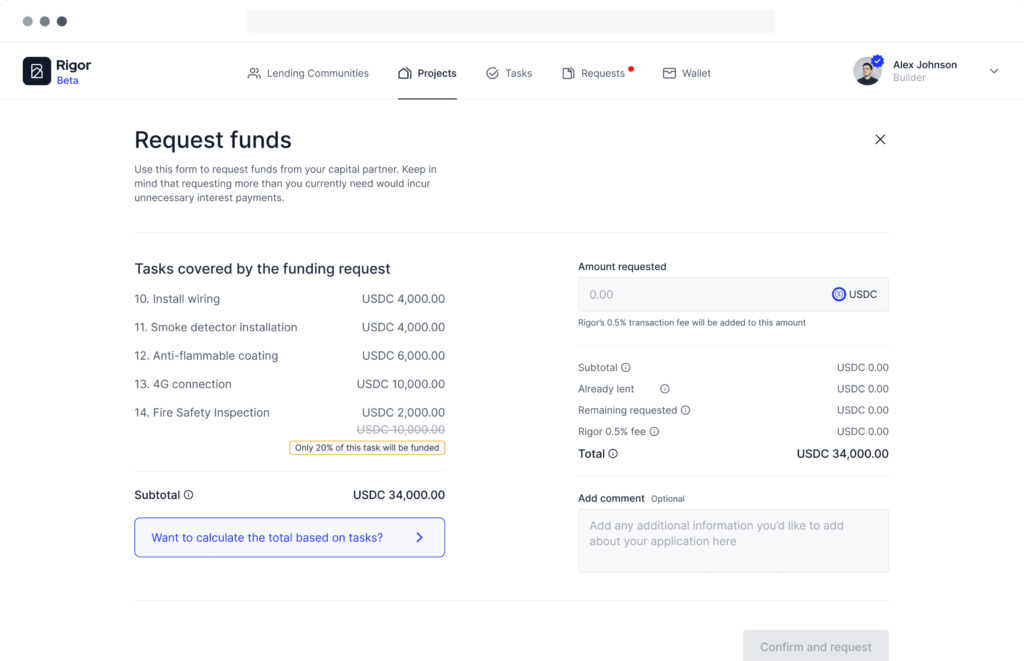

Rigor creates fixed-term yield opportunities for digital asset investors, while creating new financing options for builders. Through Rigor’s platform, lenders can find and fund construction projects. Money stays in escrow until a builder’s budgeted construction tasks are complete and verified. The builder is then paid directly, bypassing any intermediaries. The startup hopes that making these financing channels more open and more efficient will result in the construction industry being able to ramp up to meet historic levels of demand.

“We have an affordability crisis in housing because we have a capital crisis in construction lending,” commented Keith Hamlin, Managing Partner at Third Prime. “Rigor’s innovative use of blockchain technology shores up lending flows, creating confidence in the asset class so that new capital can help build more infrastructure.”

The international nature of Rigor is notable, considering that the lack of affordable housing is just as much of a problem outside the US as it is inside. By the middle of this decade, 1.6 billion people are expected to have difficulties accessing affordable housing. According to the National Association of Realtors, the US has a shortage of 7 million homes.

Currently, Rigor has a live beta use by digital asset lenders and homebuilders in Central Florida. So far, the platform has garnered a positive reception among key players in that ecosystem such as DK Kim, a homebuilder and operating partner of FL Pro Brokers in Orlando.

“You would never guess that demand for housing is at record levels when you consider the difficulties builders like us face securing and managing construction loans,” asserted Kim, who is a beta tester of the platform.

“Rigor’s tools and technology allow us to engage with and grow lending partnerships and streamline our operations,” Kim asserted. “The result is that we can build more homes with fewer headaches and deliver for more homebuyers.”

READ MORE ON REFRESH MIAMI:

- Togal.AI lands top prize at eMerge, enabling growth of construction planning platform

- The sky’s the limit for construction companies using Flexbase’s new credit card

- Casa closes $1.2M to construct software for home improvement contractors

- Virtual Badge lands $120,000 to further develop digital ID platform