By Riley Kaminer

Small businesses are a big deal. There are more than 33 million small businesses across the US that employ nearly half of all US employees, according to Forbes.

But when it comes to funding, small businesses are shortchanged. One in five small business owners that received external funds received less than they sought. And in the wake of the Silicon Valley Bank and First Republic sagas, this outlook is increasingly bleak, since bank consolidation negatively affects small business’ access to capital due to the rising cost of bank loans.

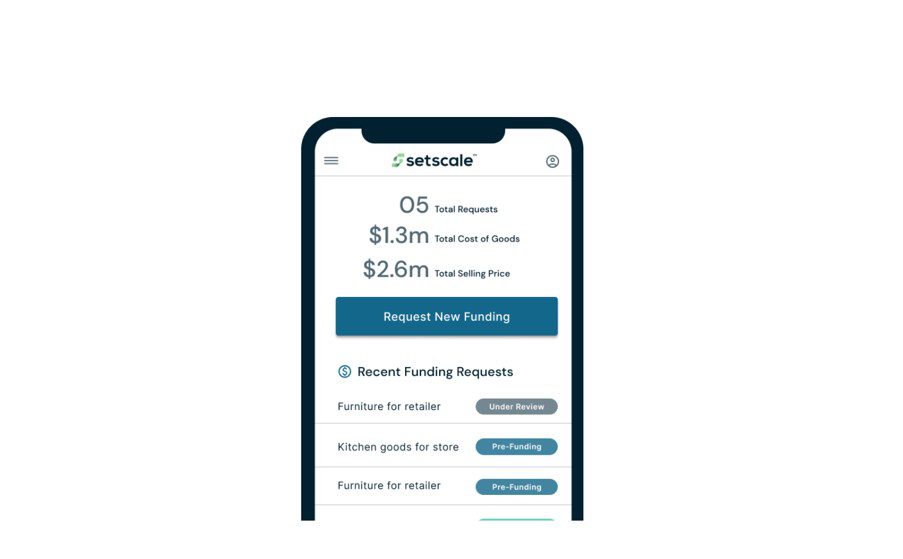

It is against this backdrop that Miami-based fintech Setscale has raised a $9.5 million seed funding round, on top of $70 million in debt financing. The startup provides small businesses with the financing needed to fill their purchase orders. The idea as this will enable these small businesses to grow by focusing more on their products and sales.

Setscale has a proprietary underwriting model that enables companies to fulfill existing orders, future orders, and inventory. Small businesses can leverage Setscale’s services on their own or in conjunction with existing capital.

According to Setscale, this equity funding will be used to expand its offerings, grow its team, and increase its marketing efforts. The debt portion of the fundraise will go towards serving its users. Participants in this round include Fin Capital, Great Oaks, Mantis, WndrCo, Ethos and Jaws – on top of a handful of angels. Already, Setscale has deployed capital across a diverse set of such as CPG, eCommerce, and manufacturing.

“As a business owner, I’ve experienced the struggles of financing purchase orders first-hand,” founder and CEO Daniel Fine said in a statement. Previously, Fine founded licensing and merchandising company NEU and sanitizing solutions and protective products company Solve Together.

“There’s clearly a need for more financing options for companies that might be overlooked by legacy financial institutions, even though there is market demand for their products,” Fine continued. “This is a critical time for companies to understand how and from where they will access capital – it’s an exciting challenge and with the support of our partners, our team is poised to help product-based companies thrive and meet consumer and B2B demand.”

Until now, Setscale had been in stealth mode. The South Florida Business Journal reported that while Miami is its official home and Fine lives and works here, many of the startup’s employees work either remotely or from their New York office.

“We are committed to supporting repeat founders and Daniel’s vast experience in many business endeavors gives him a unique perspective on what business owners need, especially in this challenging climate,” said Fin Capital’s founder and managing partner, Logan Allin. “Setscale’s innovative approach to purchase order financing is exactly the type of B2B fintech Fin Capital is excited about, bringing scalability to businesses.”

READ MORE IN REFRESH MIAMI:

- Boopos on the move: Lending platform scores $58M Series A

- OppZo provides working capital for government contractors, uplifting communities

- QUASH.ai lands $3.7M seed round to expand Latin American credit platform

- Marco secures $200M to grow LatAm-focused SME financing platform

SUPPORT LOCAL NEWS: Refresh Miami is proud to keep our news articles paywall free and accessible to all. If you enjoy our content, please consider supporting us by becoming a paid subscriber or making a donation.