By Riley Kaminer

So much for a slow August. The Refresh Miami newsroom has been buzzing with funding announcements left, right, and center this week.

The latest: a $100 million credit facility for Dania-based OneBlinc. The startup has developed a tech-enabled platform to provide consumer loans, with a particular focus on public sector workers and healthcare professionals.

CEO Fabio Torelli told Refresh Miami that this funding will enable OneBlinc to better support those who need it the most. “We are going to be able to cover more and more families and be able to expand our product offerings.”

Since being founded four years ago, OneBlinc has expanded to 250,000 members – a number Torelli hopes to grow to 1 million within the next year or two, fueled by this fundraise.

Torelli explained that the typical OneBlinc client is a middle-aged female, minority, making around $50,000 a year, and has two or three children. Often they have multiple jobs, including gig work, and are working 12 hours a day. The average loan size is $2,000 – just to help avoid overdraft fees or deal with an emergency loan. OneBlinc also enables its members to avoid predatory payday lenders.

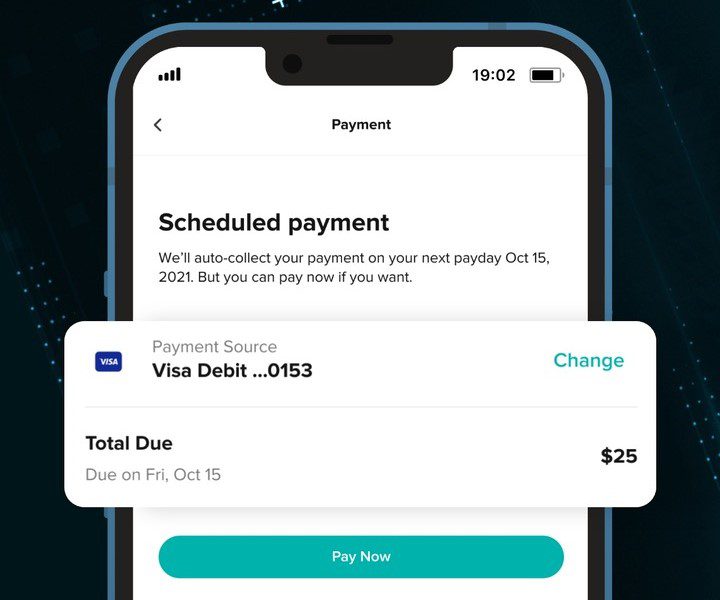

One of OneBlinc’s major differentiators is speed. The platform only takes a few minutes to make a loan decision. Meanwhile, similar platforms can take as many as five days. “We know how to underwrite underserved customers,” asserted Torelli, in part because consumers are willing to give OneBlinc insights into their financial situation so that they can easily get loans when necessary.

“Our customers see the transparency and how fast we are able to provide the funds,” said Torelli, noting that the company leverages Mastercard’s payment rails to make the payments very quickly. “At this point, we have a very good community of members that know us and recognize our company as a partner, thanks to our different approach.”

in 2022, OneBlinc raised a $20 million Series A. This enabled the company to develop an app to go alongside its website, on top of a series of additional products and services such as co-branded debit cards and more cash-back options. “We invested a lot in technology development,” said Torelli. He underscored the crucial timing of this last infusion of capital, which allowed OneBlinc to be there for its members to deal with soaring inflation.

Around half of OneBlinc’s 40 employees are based in South Florida. “It’s amazing how talent has been popping up here,” he said, specifically mentioning a partnership with the University of Miami that brought four students to help OpenBlinc.

“I’ve lived here for nine years and can see the transformation,” Torelli continued. “I’ve been very glad to experience this and somehow be part of the movement.”

READ MORE IN REFRESH MIAMI:

- OneBlinc announces new debit card offering to give underbanked Americans a leg up

- Fintech Inveniam expands to Miami, launches AI division for developing data tools for private market assets

- Lula rides in a $35.5M Series B to expand insurance platform

- Novo secures $125M to provide small businesses with working capital

- In wake of SVB and First Republic collapse, CapStack collects $6M to build inter-bank marketplace