Startup saves procurement-heavy companies 8-10% of their spend, unlocking working capital

By Riley Kaminer

Supply chain disruptions have been a wake up call for businesses and consumers alike. They have made us realize that the global market for goods is more fragile than we might have thought – and that supply chain resilience is more important than ever.

Oliver Belin is a Miami-based supply chain expert. For the better part of the last two decades, Belin has been focused on the financial side of the supply chain: aspects such as credit risk, payments, and financing.

While this area of the supply chain may tend to go a bit under the radar, it can actually have a major impact on businesses. Take payment terms, for example. As a procurer, negotiating a 90 day payment contract versus 15 days lets you keep your cash for an extra 75 days. That could allow you to forgo taking out a loan from a bank, which could be quite costly considering today’s ever-increasing interest rates.

The problem: businesses don’t have the data-driven insights necessary to optimizing their financial supply chain decision making processes.

“90% of companies in the world have this problem,” Belin told Refresh Miami. “Today, the majority of companies apply the same payment terms they have always used.”

The most sophisticated companies use Excel and optimize this manually,” Belin continued. “The very, very sophisticated competitors use PwC or McKinsey or EY – but they are also just using Excel.”

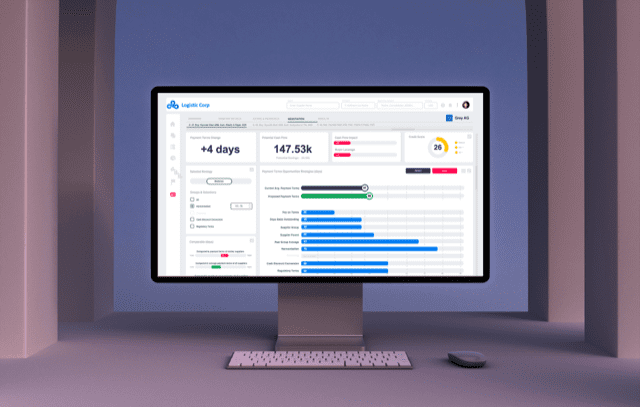

Belin began to devise a solution to this problem in 2020. In 2021, he launched Calculum, an artificial intelligence-powered platform that provides companies with insights to help them improve their payment terms and unlock more working capital.

At the core of the platform is Calculum’s database of 750,000 providers, giving users a firsthand of how their payment terms with a particular supplier compares to their competitors’. Calculum suggests the optimal payment terms, analyzing each supplier’s risks and financial metrics.

Through a recently-announced partnership with London-based InvestVerte, Calculum now provides access to ESG metrics. This empowers companies to use payment terms to incentivize suppliers to comply with ESG ratings. For instance, if a supplier improves their ESG, the procurer might give them access to less expensive financing through their banking partners.

Belin says that Calculum is able to provide 8-10% of free cash flow for every dollar of spend they analyze. That can add up, since clients on Calculum’s platform spend billions with suppliers. These clients include a major multinational pharmaceutical company and the largest treasury management solutions provider.

Currently, the platform focuses on helping procurers optimize their spend. Soon, Calculum hopes to flip this model around by also helping suppliers optimize their negotiations. The startup has a wide range of product enhancements in the pipeline as well, including the development of an API that enables their platform to plug right into their clients’ ERP systems. In January, the company raised its first seed round: $1.7 million led by Miami-based Humla Ventures.

10 of Calculum’s 15 employees are based in Downtown Miami. Belin, a native of Switzerland, has lived in Miami for five years – attracted to its international environment. This comes as an advantage for Calculum’s growth trajectory, as the company has imminent plans to expand throughout Western Europe, North America, and Latin America.

READ MORE ON REFRESH MIAMI:

- Humantelligence equips companies with the tools to achieve a high-performing culture

- SimpliRoute launches supply chain logistics platform in the US, starting with Miami

- This smart label for medications can improve healthcare outcomes at scale

- Brought together by tech, kept together by culture: Miami’s protagonistic role in LatAm’s startup story - April 15, 2024

- New World Angels launches Innovation Fund to write pre-seed checks - April 12, 2024

- Sortium scores $4M to pioneer the future of game production (hint: it’s web3 and AI) - April 11, 2024