By Riley Kaminer

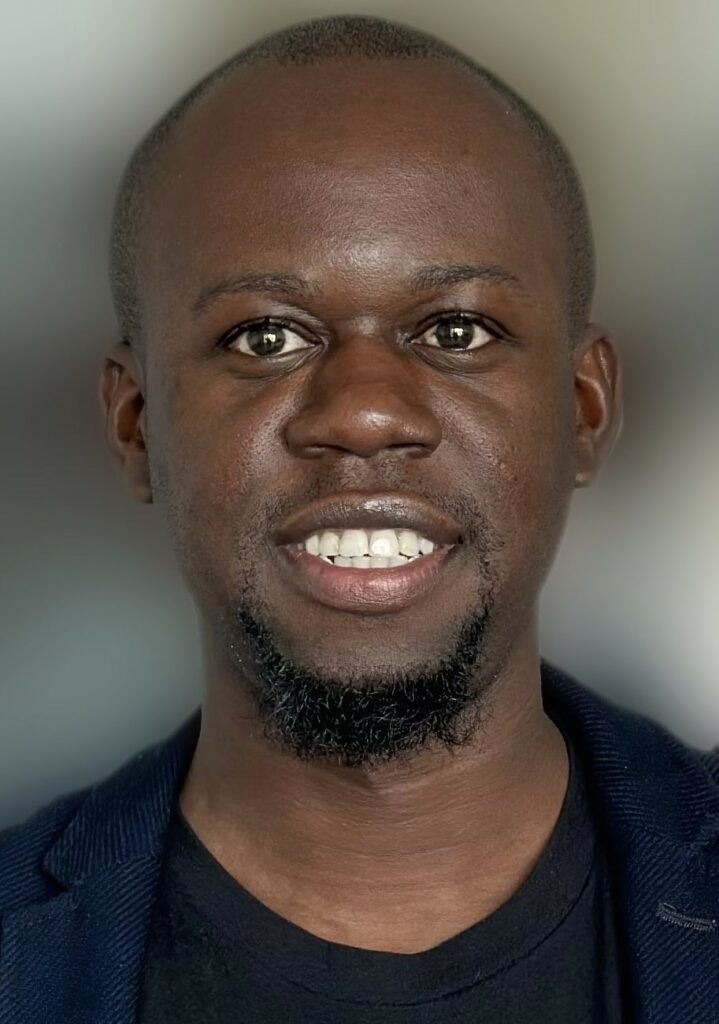

In 2017, Orville Black’s mom got injured at work. “Something triggered inside of me and said, ‘Hey, I have to help my mother,’” Black told Refresh Miami. So Black spent two years navigating a complex web of lawyers and doctors to help his mother win her workers’ comp case.

“That ended up fueling a desire inside myself,” said Black of his keen interest in helping people navigate disputes like this with their employers. Black himself, when he was 18, got assaulted by a customer while working a retail job, but didn’t have any recourse – or the financial resources – to fight back.

But things really hit a tipping point in 2020, when Black was working at a rental verification startup and witnessed many colleagues losing their jobs and essentially having to rebuild their lives from scratch.

“That’s when I decided to go solve this problem myself,” said Black. And how would he solve it? Through severance.

“Employers want to do the right thing by employees,” he asserted, and severance packages are the way to do it. This infusion of capital upon termination buys employees the time to get over the psychological and financial shock of moving jobs.

“95% of employers claim to have severance packages in place, but they don’t have the capital in order to do so.” This creates a major liability.

FairSplit, the Miami-based startup that Black leads, aims to protect companies by setting them up with an escrow account that acts as an insurance system, ensuring that companies have enough liquidity to make good on their severance liabilities. The funds remain in that account until there is a layoff, which is when the funds can be deployed.

Additionally, FairSplit has a bond system that acts as a guarantor and matches dollar-per-dollar every employer contribution. If there is not enough money in the escrow account, money can be taken out of the bond.

“Let’s say if you are reducing headcount by 20% and you don’t have enough money in your escrow account, the bond acts as a guarantor to buy you time,” Black explained. “Then you can take that capital out of the bond to pay the severance. And then you have time to pay back the bond. That’s why we say that we buy you time and save on taxes.”

The tax side of FairSplit’s equation is another unique aspect. There are tax incentives that benefit companies setting up FairSplit’s insurance system. That adds up when a company like Google lets go of 12,000 employees at once. According to FairSplit’s calculations, Google could have saved around $38.4 million by using FairSplit’s platform.

Originally from New York, Black moved to Miami in 2021 – the same year that he founded FairSplit alongside Chief Systems Officer Ryon Batson (who is also Black’s cousin) and CTO Andy Zhang.

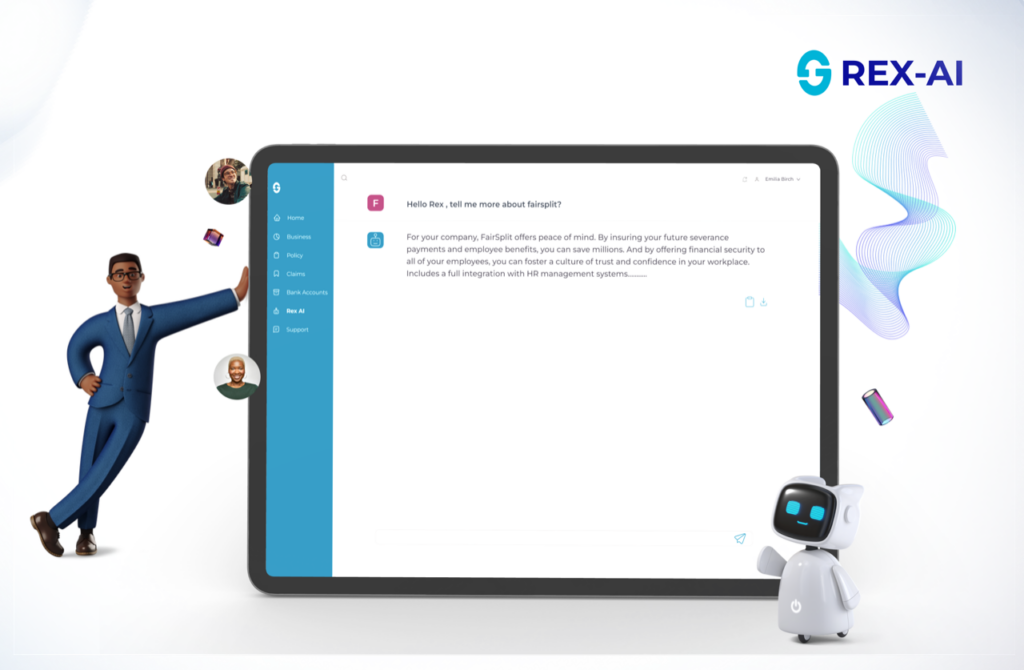

The four-person team took part in Techstars’ Miami accelerator, which Black said was a “gamechanger” for FairSplit. “It helped us so much because we had access to all the attorneys and accountants we needed to help understand the impact of the product we created.” Product development is top of mind for FairSplit, which ultimately aims to provide a wider set of services to companies by leveraging AI to analyze the data they collect from employers.

Black expressed excitement about the role FairSplit can help play in enabling local companies to grow. This includes making Miami businesses more attractive to top talent thanks to their FairSplit-powered benefits, increased employee retention and satisfaction, and boosting transparency between employers and employees.

“FairSplit can elevate Miami’s allure for both businesses and their employees, spurring economic development and job stability,” said Black.

READ MORE IN REFRESH MIAMI:

- Techstars launches accelerator in Miami to support diverse founders; applications are open

- Piloted in South America, human-resources platform Nala moves to Miami to scale up

- AI brings WorkStory’s performance review platform to the next level

- Humantelligence equips companies with the tools to achieve a high-performing culture