Amid recessionary headwinds and geopolitical shifts, optimizing supply chains and working capital has become a high priority for C-suites and boardrooms. Miami-based Calculum leverages advanced analytics and artificial intelligence-based systems to help companies select suppliers, negotiate payment terms, assess supply chain disruption risk, optimize cash flow, and improve sustainability.

Calculum announced Tuesday that fintech VC firm Vestigo Ventures led its seed round, with participation from Nevcaut Ventures, Revolution’s Rise of the Rest Seed Fund, XBTO Humla Ventures, and KD Venture Partners. Calculum did not disclose the size of the round, but Crunchbase lists it as $4.2 million.

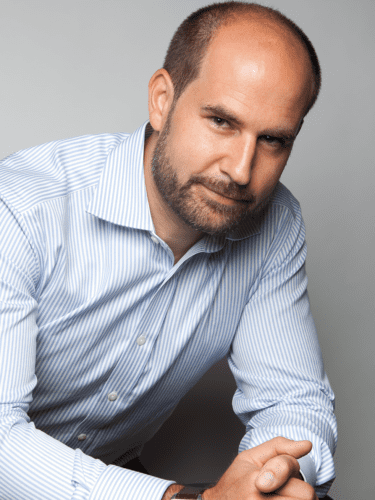

Oliver Belin, Calculum’s founder and CEO, is a Miami-based supply chain expert who has been focused for the better part of the last two decades on the financial side of the supply chain: aspects such as credit risk, payments, and financing. The problem he saw was that businesses didn’t have the data-driven insights necessary to optimizing their financial supply chain decision making processes, and in 2021 Belin and his team launched Calculum.

Today, on average, Calculum’s platform identifies up to 20% in free cash flow for every supplier spend analyze, said Belin.

“We provide insights enabling treasury and procurement teams to compare with their peers and find pockets of opportunity right down to the supplier level. We then deliver automated scripts tailored to each supplier that include all the necessary arguments teams need to negotiate better terms with confidence and gain a competitive advantage,” said Belin, a native of Switzerland who has lived in Miami since 2017.

Calculum also sees an opportunity in ESG, which is becoming an increasingly important factor in procurement negotiations. In KPMG’s 2022 Global Supply Chain Trends Survey, 53% of organizations plan to increase their focus on sustainable sourcing. Through a partnership with London-based InvestVerte announced last year, Calculum provides access to ESG metrics that help companies use payment terms to incentivize suppliers to comply with ESG rating

“Particularly now, in an environment of elevated interest rates and borrowing costs, Calculum’s AI-driven treasury solution is the technology that finance, procurement, and supply chain executives need to generate free cash flow,” said Mike Nugent, managing director at Vestigo Ventures. “[Calculum] helps companies take control of their working capital, not just as a project, but as an embedded, enterprise-wide process. It’s the competitive edge that companies need today to ensure future success.”

READ MORE IN REFRESH MIAMI:

- Are your payment terms optimized? Probably not – and it’s costing you. Calculum can help.

- Roami reels in $14M Series A to ramp up short-term rental platform

- Marco secures $200M to grow LatAm-focused SME financing platform

- Odyssey Wellness raises $6.3M Series A to grow distribution of mushroom-infused energy drink

Follow Nancy Dahlberg on Twitter @ndahlberg and email her at [email protected]